Table of Contents

2011 booms and crashes

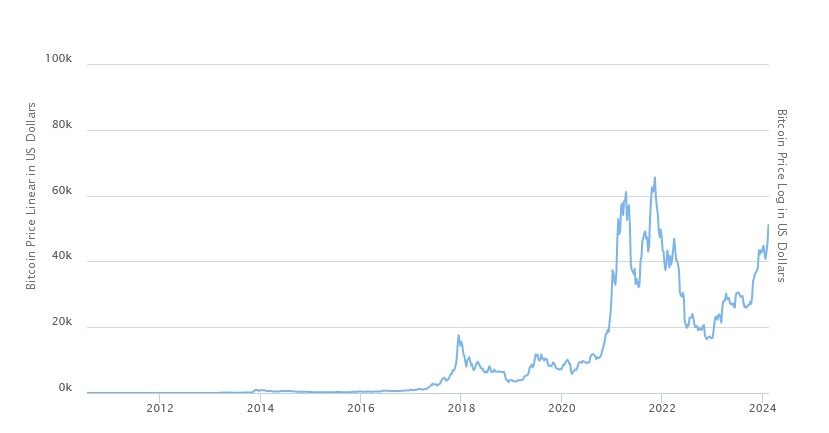

In 2011, the cryptocurrency market experienced significant booms and crashes. This can be attributed to various factors such as increased media attention, growing interest from investors, and speculative trading. Bitcoin, the first decentralized cryptocurrency, saw its value rise dramatically from a few cents to over $30 within a matter of months. This rapid surge in price led to a sense of euphoria among investors who saw the potential for substantial returns. However, this optimism was short-lived as the market quickly turned and Bitcoin’s value plummeted, causing panic and massive sell-offs.

During the 2011 booms and crashes, cryptocurrencies were still in their infancy, and there was limited understanding of their intrinsic value. This lack of comprehension, coupled with the speculative nature of the market, contributed to the volatility of prices. Investors were often driven by short-term gains, disregarding the long-term potential of cryptocurrencies. As a result, prices experienced wild fluctuations, creating a rollercoaster-like market environment. The 2011 booms and crashes marked a significant milestone in the cryptocurrency industry, highlighting the need for a more sustainable and stable market.

• Increased media attention contributed to the 2011 booms and crashes in the cryptocurrency market.

• Growing interest from investors also played a role in the volatility of prices during this time.

• Speculative trading, driven by short-term gains rather than long-term potential, further intensified market fluctuations.

• Bitcoin, as the first decentralized cryptocurrency, experienced a rapid surge in value from just a few cents to over $30 within months.

• The sudden increase in Bitcoin’s price created a sense of euphoria among investors who saw the potential for significant returns.

• However, this optimism was short-lived as Bitcoin’s value quickly plummeted, leading to panic and massive sell-offs.

• Limited understanding of cryptocurrencies’ intrinsic value at that time contributed to their volatility during the booms and crashes of 2011.

• The lack of comprehension combined with speculative nature led to wild fluctuations in prices.

• This rollercoaster-like market environment emphasized the need for a more sustainable and stable cryptocurrency market moving forward.

2013 boom and 2014–15 crash

It is during such periods that the market experiences a surge in demand for cryptocurrencies, leading to a rapid increase in their prices. The 2013 boom was no exception, as Bitcoin, the most popular cryptocurrency at the time, reached an all-time high of over $1,000. Investors were captivated by the potential of digital currencies, envisioning a future where they would revolutionize the financial industry.

However, the euphoria was short-lived. In 2014, the cryptocurrency market experienced a significant crash that extended into 2015. Bitcoin’s price plummeted to around $200, instilling panic among investors who had hoped for continued growth. Several factors contributed to the crash, including regulatory concerns, security breaches, and market manipulation. The sudden reversal in fortunes highlighted the inherent volatility of the cryptocurrency market, leading to significant financial losses for many. It served as a stark reminder that while cryptocurrencies presented enormous potential, they also came with substantial risks.

2017 boom and 2018 crash

This can lead to a surge in demand and investment, causing the prices to skyrocket. This was evident in the 2017 boom, where cryptocurrencies such as Bitcoin experienced unprecedented growth. Investors flocked to the market, driven by the fear of missing out on potential gains and the allure of quick profits. As a result, the prices of cryptocurrencies reached astronomical levels, with Bitcoin hitting an all-time high of nearly $20,000 in December 2017.

However, as with any speculative asset, the market eventually corrected itself, leading to the inevitable crash in 2018. The inflated prices proved to be unsustainable, and as investors started to take profits, panic ensued. The market sentiment shifted, and cryptocurrencies across the board began to plummet in value. Bitcoin, for instance, lost more than two-thirds of its value over the course of 2018. The crash was a stark reminder of the volatility inherent in cryptocurrency markets and served as a cautionary tale for those who had become too caught up in the hype of the boom.

2020–2022 cryptocurrency bubble

This often leads to a rapid increase in the demand for cryptocurrencies, resulting in a surge in their prices. The 2020–2022 period witnessed such a bubble in the cryptocurrency market, characterized by a speculative frenzy and a significant rise in the valuation of various digital assets.

During this period, keywords like Bitcoin, Ethereum, and altcoins dominated the headlines as their prices skyrocketed to unprecedented levels. Investors were enticed by the promise of quick and massive returns, fueling the euphoria surrounding cryptocurrencies. As more individuals flocked to invest in the market, the demand for cryptocurrencies outpaced the supply, causing their prices to surge further. Many saw this as an opportunity to capitalize on the hype and made speculative investments, hoping to ride the wave of the cryptocurrency bubble. However, history has shown us that such bubbles are often unsustainable and eventually lead to a market correction.

2021–2024 crash

A cryptocurrency bubble is a phenomenon where the market increasingly considers the going price of cryptocurrency assets to be inflated against their hypothetical value. In 2021, the bubble reached its breaking point, leading to a significant crash in the cryptocurrency market. Many factors contributed to this crash, including regulatory concerns, market manipulation, and lack of investor confidence.

One key factor that led to the 2021–2024 crash was the increasing scrutiny from regulators around the world. Governments started to take notice of the rapidly growing cryptocurrency market and began implementing stricter regulations to protect investors and maintain financial stability. The introduction of these regulations created uncertainties within the market, causing panic selling and a subsequent drop in cryptocurrency prices.

Another factor that played a role in the crash was the prevalence of market manipulation. The decentralized nature of cryptocurrencies makes them susceptible to manipulation by large investors or groups. These individuals or organizations can artificially inflate or deflate the prices of certain cryptocurrencies, leading to a distortion of their actual value. Such manipulations can create a false sense of security or fear, leading to a sudden surge or fall in prices, respectively, contributing to the overall crash.

Furthermore, the lack of investor confidence in cryptocurrencies also played a significant role in the crash. As the market experienced extreme volatility and unpredictable price fluctuations, many investors grew wary of the risks associated with cryptocurrency investments. This lack of confidence led to a mass exodus of investors, further fueling the downward spiral of prices.

In conclusion, the 2021–2024 crash in the cryptocurrency market was a result of regulatory concerns, market manipulation, and the lack of investor confidence. These factors combined to burst the cryptocurrency bubble, causing a significant drop in prices. As the market continues to evolve and mature, it remains crucial for regulators, investors, and industry players to work together to establish a more stable and secure cryptocurrency ecosystem.

Characterization as ‘bubble’

This leads to a surge in demand, causing the prices to rise rapidly and reach unsustainable levels. The speculative nature of cryptocurrencies, combined with the lack of regulation and the hype surrounding them, often fuels these bubbles.

One of the key factors contributing to the characterization of cryptocurrencies as a bubble is the volatility they exhibit. Cryptocurrency prices can swing dramatically within a short period, creating opportunities for huge gains but also exposing investors to significant losses. This extreme price volatility makes it difficult to determine the true underlying value of cryptocurrencies, leading to speculation and a potential disconnect between prices and actual worth.

Furthermore, the rapid rise and fall of cryptocurrency prices have caught the attention of skeptics, who argue that these digital assets have little intrinsic value. They believe that the high prices seen during cryptocurrency booms are inflated and unsustainable, akin to a speculative bubble. The lack of tangible assets backing cryptocurrencies, coupled with the perception that they are a purely digital creation, further supports the notion of a bubble in the eyes of critics.

While some enthusiasts argue that cryptocurrencies are a revolutionary technology with the potential to change the financial landscape, others view them as a speculative asset class prone to frequent bubbles and subsequent crashes. The characterization of cryptocurrencies as a bubble is heavily debated, with proponents and skeptics presenting contrasting arguments. As the cryptocurrency market continues to evolve, it remains a subject of scrutiny, with its portrayal as a bubble being one of the prevailing narratives surrounding this emerging industry.